Do you operate a small to medium business?

Are you looking to either replace or expand your current vehicle fleet?

If the answer to this is yes then there is great news for you to consider doing this before the end of the year.

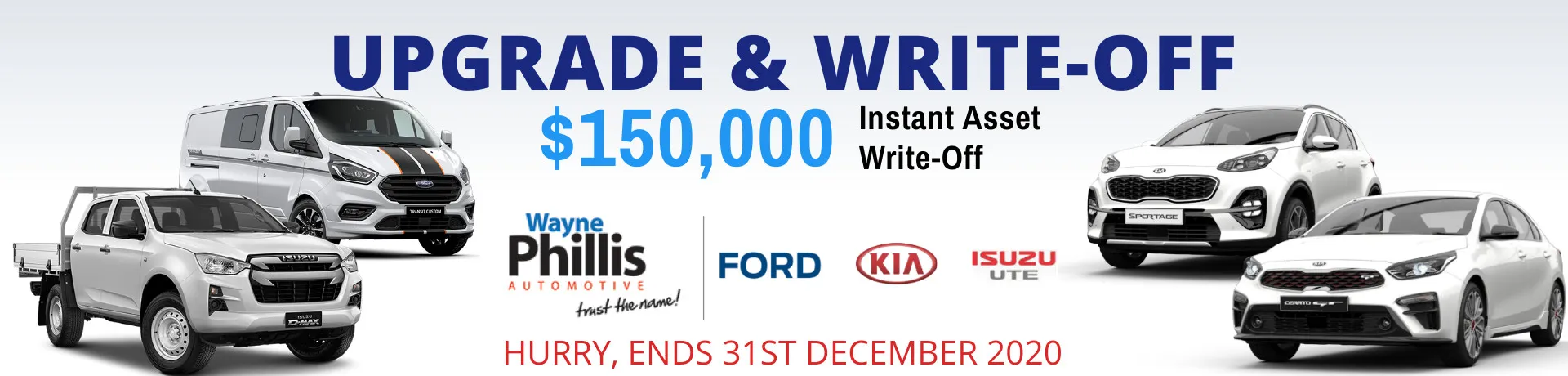

As a part of the Australian Government’s recent financial stimulus package for small to medium business as a response to the challenges of COVID-19, the Instant asset write-off threshold has been increased to $150,000 per asset# The recent changes to these rules mean that small and medium businesses can potentially instantly write off the value of the asset rather than depreciate it over many years.

All new Isuzu D-Max comes in many shapes and sizes and is arguably one of Australia’s best Light Commercial vehicles backed by a 6 year factory warranty starting from $29,990 drive away, why not look at putting yourself into a new Isuzu D-Max ute this financial year.

So what are you awaiting for….if you have an ABN call me today on 0429 674 782 and see how I can tailor a fleet solution to you and your business!

* You should always seek your own independent taxation advice taking into account your own specific situation when considering the Instant Asset Write Off.

Ford Line

Ford has an expansive commercial range of vehicles starting with the Ranger through to our Transit Custom and Transit Van range each with its own distinctive market appeal. Backed by a 5 year, unlimited km manufacturer warranty now is the time to potentially take advantage of the Instant Asset Write off and either add to or upgrade your fleet. Call us now for a no obligation review of your current fleet and see how you can make the most of this unique opportunity.

Kia Line

With a range of vehicles to suit most industries, Kia has vast choice from the small hatch of Picanto right through to the People Mover of Carnival, and the ever popular mid size SUV. Backed by a 7 yr, unlimited km warranty why wouldn’t you look at Kia for your fleet. Take the time to see for yourself how you could make the most of the Instant Asset allowance and either upgrade or expand your fleet.

T&C’s apply

Do you operate a small to medium business?

Are you looking to either replace or expand your current vehicle fleet?

If the answer to this is yes then there is great news for you to consider doing this before the end of the year.

As a part of the Australian Government’s recent financial stimulus package for small to medium business as a response to the challenges of COVID-19, the Instant asset write-off threshold has been increased to $150,000 per asset# The recent changes to these rules mean that small and medium businesses can potentially instantly write off the value of the asset rather than depreciate it over many years.

All new Isuzu D-Max comes in many shapes and sizes and is arguably one of Australia’s best Light Commercial vehicles backed by a 6 year factory warranty starting from $29,990 drive away, why not look at putting yourself into a new Isuzu D-Max ute this financial year.

So what are you awaiting for….if you have an ABN call me today on 0429 674 782 and see how I can tailor a fleet solution to you and your business!

* You should always seek your own independent taxation advice taking into account your own specific situation when considering the Instant Asset Write Off.

Ford Line

Ford has an expansive commercial range of vehicles starting with the Ranger through to our Transit Custom and Transit Van range each with its own distinctive market appeal. Backed by a 5 year, unlimited km manufacturer warranty now is the time to potentially take advantage of the Instant Asset Write off and either add to or upgrade your fleet. Call us now for a no obligation review of your current fleet and see how you can make the most of this unique opportunity.

Kia Line

With a range of vehicles to suit most industries, Kia has vast choice from the small hatch of Picanto right through to the People Mover of Carnival, and the ever popular mid size SUV. Backed by a 7 yr, unlimited km warranty why wouldn’t you look at Kia for your fleet. Take the time to see for yourself how you could make the most of the Instant Asset allowance and either upgrade or expand your fleet.

T&C’s apply